Vintage Yacht Insurance

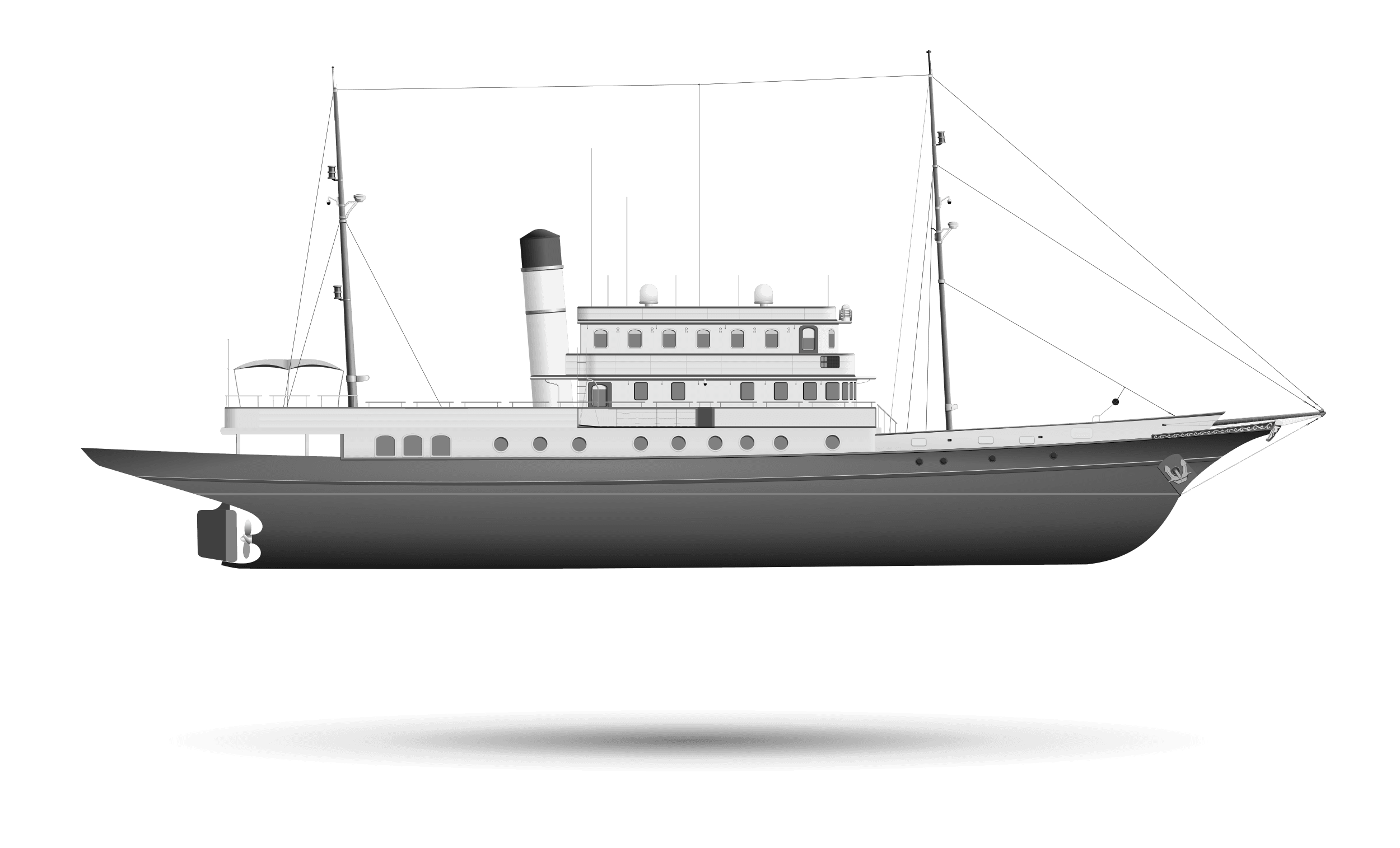

Vintage Yachts embody a rich legacy of tradition, artistry, and historical significance. These vessels are celebrated for their elegant design, crafted with the finest materials and built using time-honored techniques passed down through generations. They stand timeless as a testament to masterful craftsmanship.

For both, vintage motor and vintage sailing yachts, wood and steel remain the materials of choice. It's essential to understand the distinctions between smaller and larger vintage yachts. Owners of smaller vessels often take pride in managing the upkeep themselves, sometimes with the help of a trusted shipwright. In contrast, larger yachts usually require a dedicated maintenance team, often including a permanent crew, to ensure the vessel stays in impeccable condition.

Vintage yachts often struggle to secure adequate insurance coverage due to several factors. Many insurance providers have underwriting guidelines that prohibit coverage for older yachts, regardless of their condition. Additionally, trading restrictions and the high costs of sourcing or replacing parts for older vessels contribute to the challenges of finding optimal insurance coverage. Insurers also face pressure to swiftly assess documentation, which can lead to rushed decisions. In some cases, discrepancies between a yacht's size and its appraised value further complicate the underwriting process.

At Sealogy, we deeply appreciate the dedication it takes to own and maintain a vintage yacht. Our insurance coverage solutions and extensive yacht insurance expertise and experience help us tailor insurance coverage to meet your needs and priorities, providing peace of mind and protection that allow you to live your passion to the fullest.