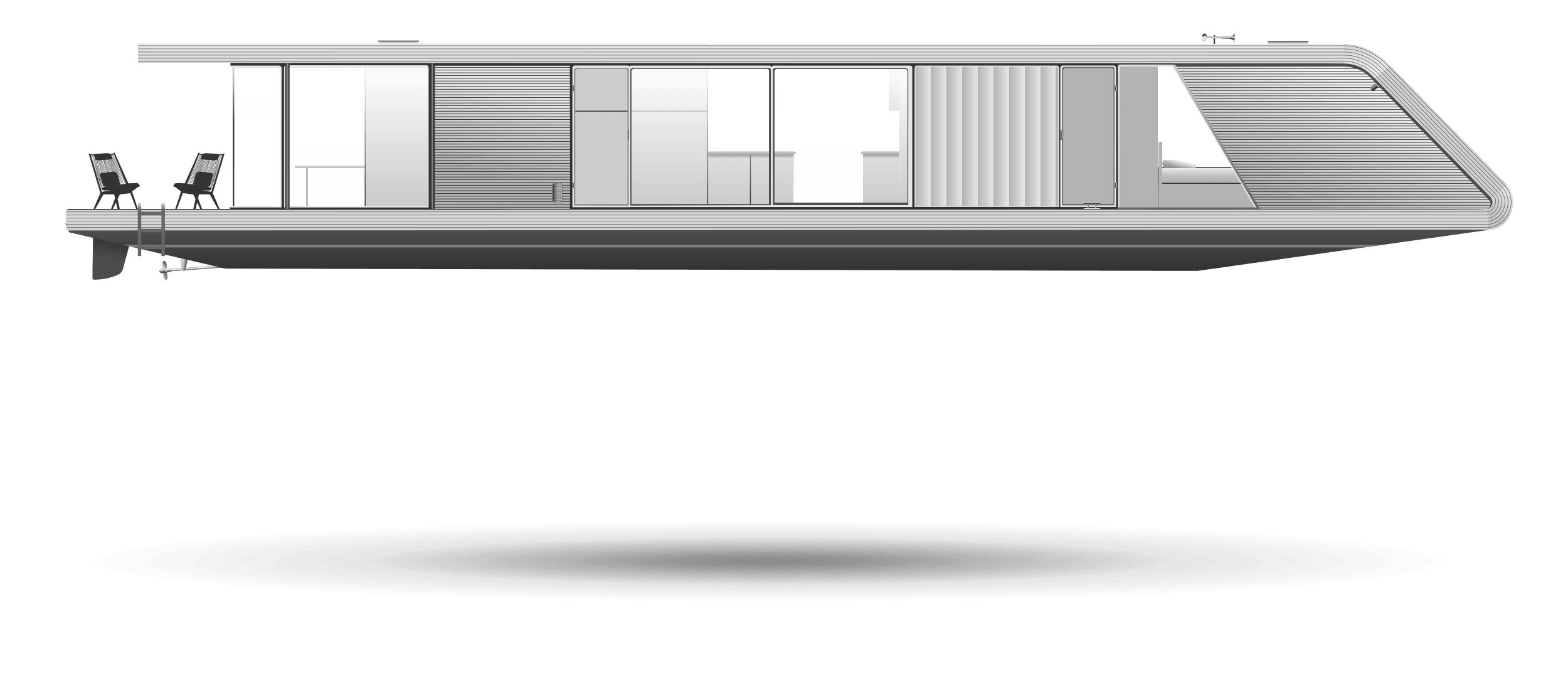

Houseboats, once simple floating homes, have evolved into luxurious residences that offer the best of both worlds—life on the water with all the comforts of a high-end home. These modern houseboats often feature sophisticated interiors, complete with upscale kitchens, spacious living areas, and state-of-the-art amenities, blurring the lines between a traditional home and a vessel.

From an insurance perspective, the shift toward luxury has introduced new considerations. Today’s houseboats often resemble houses more than boats, leading to insurance needs that are more aligned with those of traditional homes. Water damage, for example, is a common concern—not from external sources, as one might expect with a vessel, but from within the boat itself, such as from plumbing issues or appliance leaks. These types of damages are more typical of household insurance claims than maritime ones.

Another relevant factor influencing insurance coverage is the value of the household and personal effect aboard the houseboat. As houseboats become more luxurious, they are often furnished with high-end appliances, electronics, and furniture, significantly increasing the overall value. This means that the contents of the houseboat can heavily influence the insurance premium, similar to how a homeowner’s insurance policy might be structured.

At Sealogy, we recognize that these modern houseboats require specialized insurance coverage that reflects their unique blend of luxury living and maritime mobility. Our tailored insurance solutions are designed to protect not just the structure of the houseboat, but also the valuable contents within, ensuring comprehensive coverage that offers peace of mind for those who choose to live life on the water in style.